UHC Hospital & Indemnity Coverage

Underwritten by Golden Rule Insurance Co

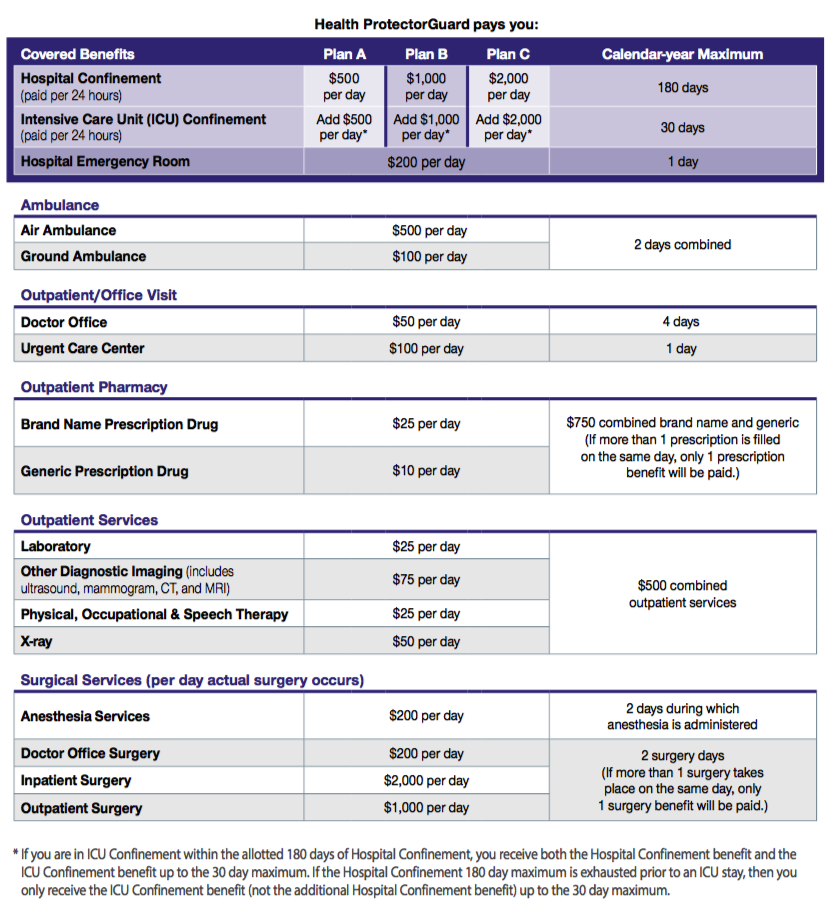

Health ProtectorGuard plans are designed to supplement health insurance and assist you with costs incurred from hospital services, helping to lower their out-of-pocket expenses. These UHC plans pay a fixed amount per day for Hospital Confinement, ICU Confinement, Emergency Room, plus other medical services up to the calendar year maximum. You can pair these plans with a regular health insurance plan to protect yourself from unexpected costs and lower your out-of-pocket expenses, including a High Deductible Health Plan. Our Rating: ★★★★☆

Why should I consider this coverage?

With Health ProtectorGuard:

- Benefit payments are paid in a lump sum directly to you and can be used however you like. Save them, pay medical bills, or even use them to help cover living expenses like groceries, mortgage/rent, and child care.

- You are not limited by provider networks.

- You will be paid the same amount no matter what provider you choose to see.

- There is no deductible or waiting period to meet prior to receiving benefit payments.

- Coverage available for individual or entire family.

- Guaranteed renewable to age 6

- Lifetime maximum benefit: $1,000,000 per covered person.

What To Know

![]()

No network limitations.

![]()

No deductible or waiting period.

![]()

Renewable coverage until age 65.

Health ProtectorGuard Benefits

What's Not Covered (all plans)

-

- For non-emergency services or supplies received from a provider who is not a network provider, except as specifically provided for by the policy.

- For a preexisting condition — A condition:

(1) for which medical advice, diagnosis, care, or treatment was recommended or received within the 24 months immediately preceding the date the covered person became insured under the policy/certificate; or (2) that had manifested itself in such a manner that would have caused an ordinarily prudent person to seek medical advice, diagnosis, care, or treatment within the 12 months immediately preceding the date the covered person became insured under the policy/certificate.

-

- A pregnancy existing on the effective date of coverage will also be considered a preexisting condition.

- NOTE: Even if you have had prior Golden Rule coverage and your preexisting conditions were covered under that plan, they will not be covered under this plan.

- That would not have been charged if you did not have insurance.

- Incurred while your coverage is not in force.

- Imposed on you by a provider (including a hospital) that are actually the responsibility of the provider to pay.

- For services performed by an immediate family member.

- That are not identified and included as covered expenses under the policy/certificate or are in excess of the eligible expenses.

- For services that are not covered expenses.

- For services or supplies that are provided prior to the effective date or after the termination date of the coverage.

- For weight modification or surgical treatment of obesity, including wiring of the teeth and all forms of intestinal bypass surgery.

- For breast reduction or augmentation.

- For drugs, treatment, or procedures that promote conception.

- For sterilization or reversals of sterilization.

- For fetal reduction surgery or abortion (unless life of mother would be endangered).

- For treatment of malocclusions, disorders of the temporomandibular joint (TMJ) or craniomandibular disorders.

- For modification of the physical body in order to improve psychological, mental, or emotional well-being, such as sex-change surgery.

- Not specifically provided for in the policy, including telephone consultations, failure to keep an appointment, television expenses, or telephone expenses.

- For marriage, family, or child counseling.

- For standby availability of a medical practitioner when no treatment is rendered.

- For hospital room and board and nursing services if admitted on a Friday or Saturday, unless for an emergency, or for medically necessary surgery that is scheduled for the next day.

- For dental expenses, including braces and oral surgery, except as provided for in the policy/certificate.

- For cosmetic treatment.

- For reconstructive surgery unless incidental to or following surgery or for a covered injury, or to correct a birth defect in a child who has been a covered person since childbirth until the surgery.

- For diagnosis or treatment of learning disabilities, attitudinal disorders, or disciplinary problems.

- For diagnosis or treatment of nicotine addiction.

- For charges related to, or in preparation for, tissue or organ transplants, except as expressly provided for under Transplant Services.

- For high-dose chemotherapy prior to, in conjunction with, or supported by ABMT/BMT, except as specifically provided under the Transplant Expense Benefits provision.

No benefits are payable for expenses:

-

- For eye refractive surgery, when the primary purpose is to correct nearsightedness, farsightedness, or astigmatism.

- While confined for rehabilitation, custodial care, educational care, nursing services, or while at a residential treatment facility, except as provided for in the policy/ certificate.

- For eyeglasses, contact lenses, hearing aids, eye refraction, visual therapy, or any exam or fitting related to these devices, except as provided for in the policy/ certificate.

- Due to pregnancy (except complications), except as provided in the policy/certificate.

- For diagnostic testing while confined primarily for well-baby care, except as provided in the policy/certificate

-

- For treatment of mental disorders or substance abuse including court-ordered treatment for programs, except as provided in the policy/certificate.

- For preventive care or prophylactic care, including routine physical examinations, premarital examinations, and educational programs, except as provided in the policy/ certificate.

- Incurred outside of the U.S., except for emergency treatment.

- Resulting from declared or undeclared war; intentionally self-inflicted bodily harm (whether sane or insane); or participation in a riot or felony (whether or not charged).

- For or related to durable medical equipment or for its fitting, implantation, adjustment or removal or for complications therefrom, except as provided for in the policy/certificate.

- For outpatient prescription drugs, except as provided for in the policy/certificate.

- For surrogate parenting

- For treatments of hyperhidrosis (excessive sweating).

- For alternative treatments, except as specifically covered by the policy/certificate, including: acupressure, acupuncture, aromatherapy, hypnotism, massage therapy, rolfing, and other alternative treatments defined by the Office of Alternative Medicine of the National Institutes of Health.

- If you entered into a settlement that waives your right to recover future medical benefits under a workers’ compensation law or insurance plan, this exclusion will still apply.

- Resulting from intoxication, as defined by state law where the illness or injury occurred, or while under the influence of illegal narcotics or controlled substances, unless administered or prescribed by a doctor.

- For joint replacement, unless related to an injury covered by the policy/certificate.

- For non-emergency treatment of tonsils, adenoids, hemorrhoids or hernia.

- For injuries sustained during or due to participating, instructing, demonstrating, guiding, or accompanying others in any of the following: sports (professional, or semi-professional, or intercollegiate except for intramural), parachute jumping, hang-gliding, racing or speed testing any motorized vehicle or conveyance, scuba/skin diving (when diving 60 or more feet in depth), skydiving, bungee jumping, or rodeo sports.

- For injuries sustained during or due to participating, instructing, demonstrating, guiding, or accompanying others in any of the following if the covered person is paid to participate or to instruct: operating or riding on a motorcycle, racing or speed testing any non-motorized vehicle or conveyance, horseback riding, rock or mountain climbing, or skiing.

- For injuries sustained while performing the duties of an aircraft crew member, including giving or receiving training on an aircraft.

- For vocational or recreational therapy, vocational rehabilitation, or occupational therapy, except as provided for in the policy/certificate.

- Resulting from experimental or investigational treatments, or unproven services.

Resulting from or during employment for wage or profit, if covered or required to be covered by workers’ compensation insurance under state or federal law.